Why Agriculture Finance

Why agriculture finance

Over 56% of India’s population is engaged in agriculture and allied activities. Farmers contribute to food security and attaining food self-sufficiency. To maintain and increase productivity levels and diversify their sources of income, farmers need more capital. Small and marginal farmers with meagre savings require an even higher input of capital. Access to credit can empower farmers and enable them to invest agricultural capital in order to increase farm income and household well-being.

Our approach

Recognising the role that it could play in providing access to credit, FWWB’s Agriculture Finance Program was initiated in the year 2007. The program is aimed at providing loan support to Farmer Producer Collectives (FPC) of small and marginal farmers across various states of India. This is achieved by supporting community-based organisations in creating alternative livelihoods or income sources to improve the economic conditions of households.

The program nurtures the FPCs by providing them need-based working capital and capacity building support. The ultimate aim is to help them become sustainable and establish linkages with formal financial institutions in the subsequent years.

Salient features of FWWB's offerings

- Processing fees nil

- Cash flow-based financing, Taylor made-repayment schedule based on business activities of the FPCs

- The loan can be availed in multiple tranches, pre-payment is allowed without any penalty

| Economic Survey 2021-22: Agri-sector snapshot | |

| Registered growth in 2020-21 | 3.6% |

| Registered growth in 2021-22 | 3.9% |

| Real GDP expansion was driven by Agri sector in Indian Economy | 9.2% |

| Challenges for Small & Marginal Farmers: | |

|

|

BENEFITS OF Aggregation

- Lower the transaction costs

- Access to market

- Better prices for the produces

- Database creation for Agritech, Fintech, and Agri-startups

- Access to efficient & affordable solutions

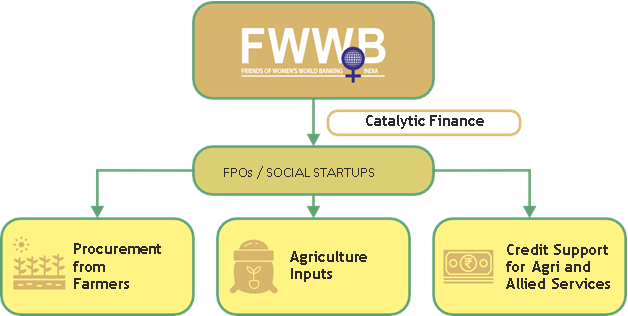

FWWB's Offering: The Agri-Finance Program

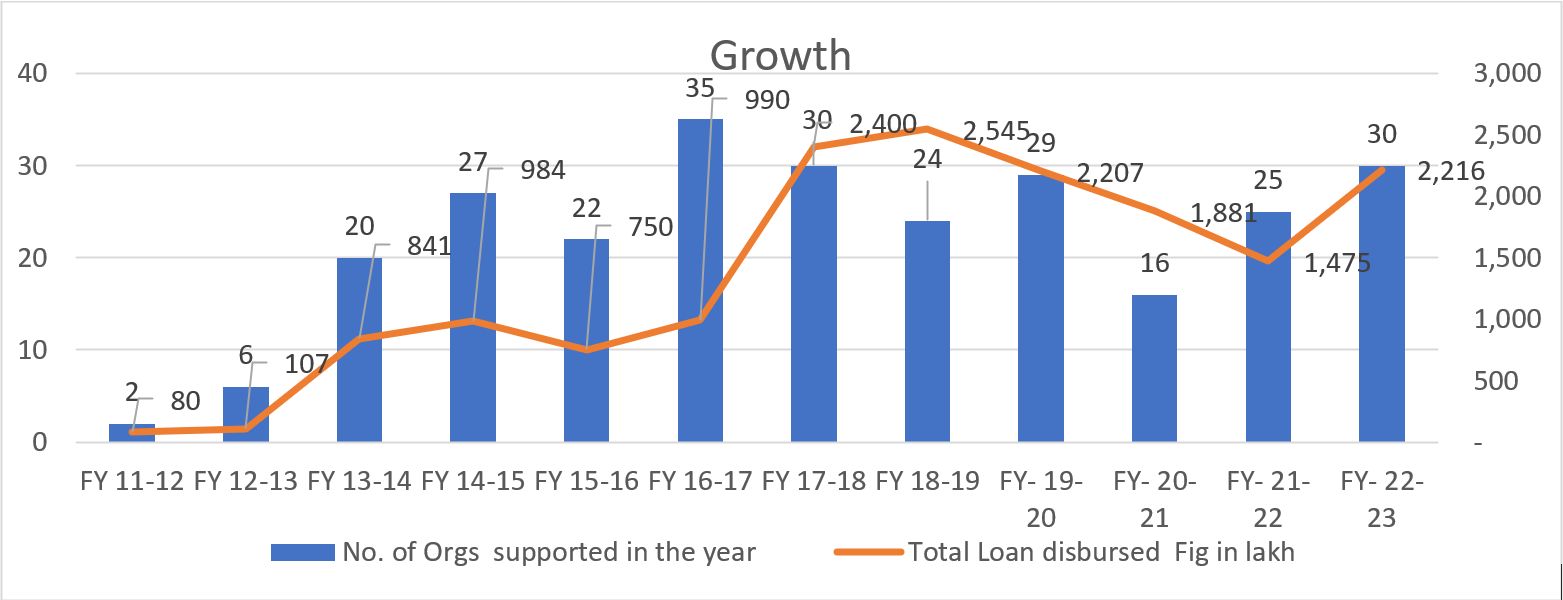

FWWB's Agri-Finance Program has been working to provide catalytic finance to nascent FPOs/FPCs since 2011. Till now, we have disbursed Rs. 164 cr to 138 institutions working with farmers and FPOs.

| Target Beneficiaries | FPCs | Societies | Co-operatives | MACS | Section 8 | FPO-associated private companies |

| Focus areas |

Working Capital for:

|

Loans for:

|

||||